Gearbox

Industrial gearbox market, growth, trends (2022 – 2027)

Market Overview

The global industrial gearbox market was valued at USD 24.90 billion in 2020, and it is expected to reach USD 31.31 billion by 2026, registering a CAGR of 4.20% during the forecast period of 2021-2026. The economic uncertainty of COVID-19 during 2020 in major developing countries had a negative impact on the market. The economic slowdown affected all the major end-user sectors of the industrial gearbox market, i.e., power, metals, mines and minerals, etc. Additionally

, the COVID-19 outbreak severely affected the supply chain of almost all the major industries across the world. Growing adoption of industrial automation across various industrial sectors, like manufacturing, steel, and food and beverages, is expected to drive the market during the forecast period. However, factors such as travel bans, manufacturing facilities shutdowns, and delays in the projects are expected to have a negative impact on the industrial gearbox market, thus, restraining the market growth.

- Helical type gearbox is expected to dominate the market during the forecast period, owing to the defining features and its advantages when compared to other gearboxes.

- Soaring demand for energy efficient gearboxes are expected to create immense opportunities for the global industrial gearbox market in the coming years.

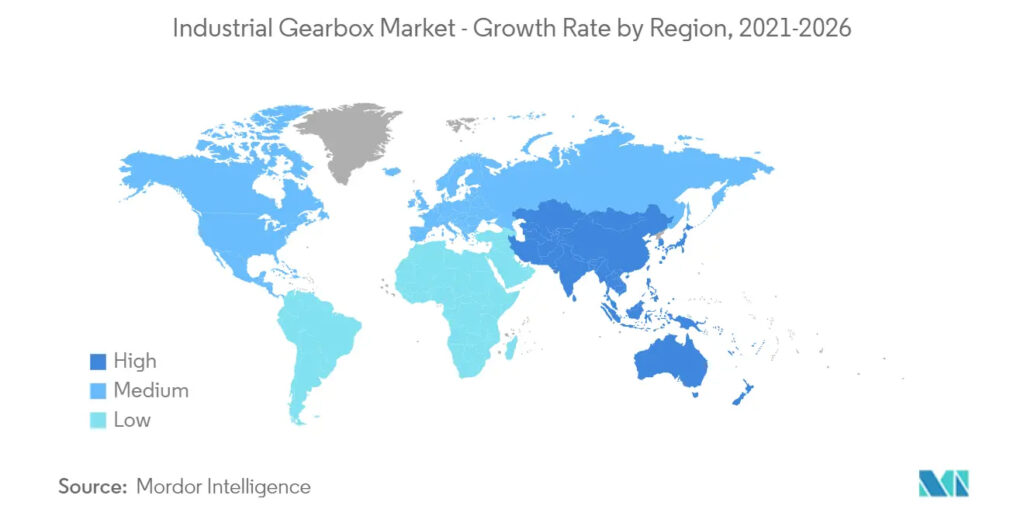

- Asia-Pacific is expected to dominate the industrial gearbox market during the forecast period, with the majority of the demand coming from China, India, and Japan.

Helical Gearbox Type Segment to Dominate the Market

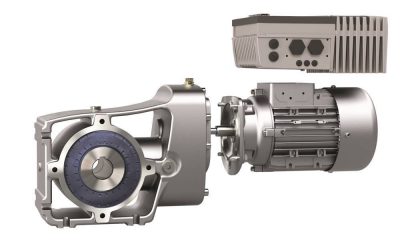

- In a helical gearbox, the teeth on a helical gear cut at an angle to the face of the gear. During the process, when two of the teeth start to engage, the contact is gradual, starting off at one end of the tooth and maintaining contact as the gear rotates in full engagement. Thereby, it offers both the capacity to conduct a smooth operation and high thrust outputs. In the field of automobile transmissions, it is the most used gears as it generates large amounts of thrust.

- Defining features of helical gearboxes include extremely high output torques, silent operation, and long service life. Helical Gearboxes are the most efficient gearboxes manufactured in the industry and work at 98% efficiency, after Planetary Gearboxes. Due to its high efficiency and high thrust generating capabilities, helical gearboxes are utilized in major industries, like fertilizer, automobile, steel, rolling mills, power, and port industries, and manufacturing sectors, such as textile, plastics, and food.

- Helical Gearbox is used in the medium and heavy-duty industrial applications in automobile transmissions, as it is capable of handling high speeds and high loads. The modular design and construction offer many engineering and performance benefits, including a high degree of interchangeability of parts and sub-assemblies. This, in turn, provides considerable economies of production while maintaining the highest standard of component integrity.

- Auto sales suffered immensely during the beginning of the pandemic (early 2020), with major markets, such as China, the United States, and Europe, facing large drops in the sales volume. However, sales volumes have recovered significantly since then. As the automobile industry recovers steadily from the effects of the pandemic, the growth in the demand for automobiles, globally, is expected to positively impact the demand for helical gearboxes in the automotive sector.

- As the automotive industry transitions its focus toward electric vehicles, the integration of helical gearboxes in the EV transmission is expected to impact the demand for helical gearboxes positively. As the EV sales grow, the development of affordable all-electric transmission powertrains remains a significant growth opportunity for the helical gearbox market.

- Therefore, based on the above-mentioned factors, helical gearbox type segment is expected to dominate the market during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region accounted for the significant share in the industrial gearbox market in 2020, owing to the increasing demand for gearoxes in various applications like manufacturing sector, power industry, etc. Countries, such as India, China, Japan, Korea, and Australia, are the key contributing nations in the region.

- China has been an essential factor in the growth of the manufacturing sector worldwide. The country is the leader in the steel, chemical, power, and cement industries, and it is one of the top players in the petrochemical and refining industries. Despite the outbreak of COVID-19, the industrial sector in the country has been registering a growth of over 3% since April 2020, reaching an all time high of 35.1% growth in January 2021.

- Moreover, steel production in 2020 registered an increase of 6.5% compared to the previous year. China has been the biggest crude steel producer and exporter, accounting for more than half of global production. China’s One Belt One Road project, to bridge the infrastructure gap in the region, is expected to boost the steel demand. Furthermore, as of August 2021, the country has ongoing expansion in one refinery, and three new refineries are expected to begin operations in 2021. One refinery is expected to begin operation by 2022. Hence, with the expansion of refineries and petrochemical business and the upcoming coal-fired plants, the country is expected to witness an increase in the industrial gearbox’s installations in the energy sector during the forecast period.

- Also, India is the world’s fourth-largest onshore wind market by installations, with 38.6 GW of wind capacity as of 2020. The wind power market in the country has been growing by two fundamental drivers: rising energy demand and governmental targets. Also, India is presently trying to expand its green energy portfolio by harnessing the entirely unexploited offshore wind energy potential along its 7,600-kilometer coastline. Hence, once the true potential is realized, the demand for industrial gearbox in wind power sector is expected to increase in upcoming years.

- Therefore, based on the above mentioned factors, Asia-Pacific is expected to dominate the global industrial gearbox market during the forecast period.

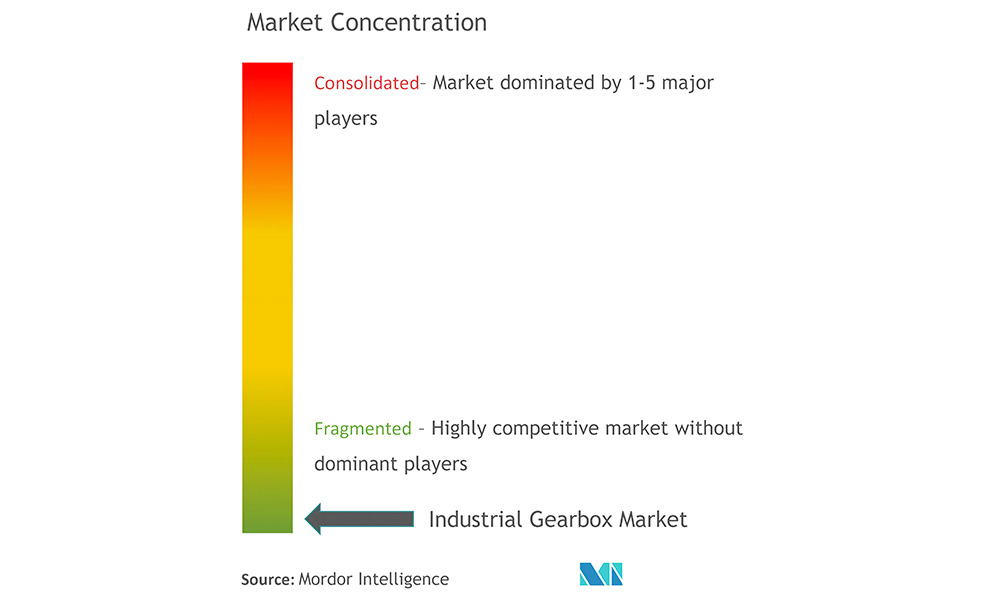

Competitive Landscape

The industrial gearbox market is moderately consolidated. Some of the major players include Nanjing High Accurate Drive Equipment Manufacturing Group Co. Ltd, Lenze SE, Flender Ltd, Nord Drivesystems Pvt Ltd, and Bosch Rexroth AG.

Major Players

- Nanjing High Accurate Drive Equipment Manufacturing Group Co. Ltd

- Lenze SE

- Flender Ltd

- Nord Drivesystems Pvt Ltd

- Bosch Rexroth AG

- Nanjing High Accurate Drive Equipment Manufacturing Group Co. Ltd Lenze SE Flender Ltd Nord Drivesystems Pvt Ltd Bosch Rexroth AG

Source: Mordor Intelligence

-

Drive systems5 years ago

Drive systems5 years agoIntelligent frequency inverters for digital production

-

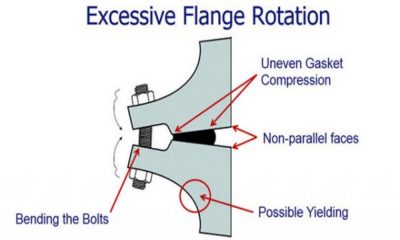

Industrial Hardware and Machine Parts8 years ago

Industrial Hardware and Machine Parts8 years agoThe necessity of bolted flange connection training

-

Motors8 years ago

Motors8 years agoNew generation of hollow shaft motors

-

Industrial Hardware and Machine Parts7 years ago

Industrial Hardware and Machine Parts7 years agoABB and Formula E partner to write the future of e-mobility

-

Industrial Hardware and Machine Parts7 years ago

Industrial Hardware and Machine Parts7 years agoRexnord adds to its Autogard Torque Limiters with the XG Series

-

Motors8 years ago

Motors8 years agoZF Technology on the Winners’ Podium of the Dakar Rally 2017

-

Gear drives7 years ago

Gear drives7 years agoKlingelnberg at control 2018: Tactile and optical measurement on one machine

-

Motors8 years ago

Motors8 years agoGet a first-class ticket to productivity

-

Motion control7 years ago

Motion control7 years agoWhere the robots come from?

-

Motion control7 years ago

Motion control7 years agoRexnord to Acquire Centa Power Transmission

-

POWER TRANSMISSION TECHNOLOGIES4 years ago

POWER TRANSMISSION TECHNOLOGIES4 years agoEUROTRANS Board meets for its first session in 2021

-

Industrial Hardware and Machine Parts8 years ago

Industrial Hardware and Machine Parts8 years agoCustom hobbing tool enables 45-degree angles