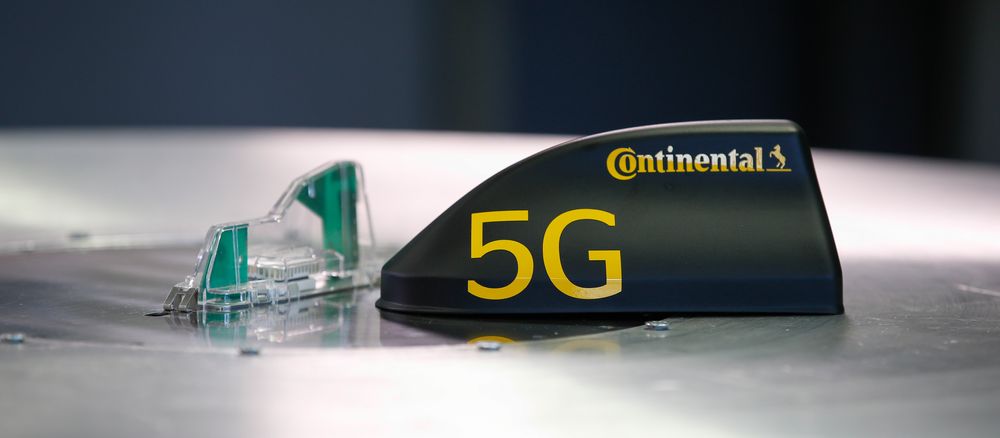

Automotive

Continental Achieves Good Result, Confirming its Course for the Future

Continental achieved a good result in the first quarter of 2021 in a persistently challenging market environment. At the same time, the mobility supplier pushed ahead with the implementation of its realigned strategy by making a number of key decisions. “We are making noticeable progress and tackling the tasks at hand systematically. With the latest resolutions, the spin-off of Vitesco Technologies this year draws nearer as planned, and from January 1, 2022, we will manage the two areas of “Autonomous mobility” and “Safety” as independent business areas. This will give us clarity while providing more freedom to define the separate and diverse strategies. We are focusing systematically on growth and pioneering future technologies when it comes to assisted, automated and autonomous driving. And we are focusing on value when it comes to safety,” said Nikolai Setzer, Continental CEO, when presenting the company’s quarterly results on thursday in Hanover.

In view of the adverse effects of the coronavirus pandemic and the resulting tight global supply situation for semiconductors, Setzer was satisfied with the quarterly result: “From an operational perspective, we have made a good start to the fiscal year.” The development of the business in China was particularly positive compared with the same quarter of the previous year, which was severely affected by the coronavirus pandemic. The tire business and the ContiTech business area stood out in particular.

Overall, consolidated sales in the first three months of the year amounted to €10.3 billion (Q1 2020: €9.9 billion, +3.5 percent). Before changes in the scope of consolidation and exchange rate effects, sales rose by 8.6 percent. Adjusted EBIT increased year-on-year to €834 million (Q1 2020: €433 million, +92.5 percent), resulting in an adjusted EBIT margin of 8.1 percent (Q1 2020: 4.4 percent). Net income totaled €448 million (Q1 2020: €292 million). In the first quarter, free cash flow before acquisitions, divestments and carve-out effects was €670 million (Q1 2020: -€148 million). The improvement in free cash flow was due in particular to the low level of capital expenditure before financial investments, which accounted for 2.8 percent of sales in the first quarter.

With regard to further business development, Setzer underlined the difficult market environment: “The coming months will remain very challenging. The global economy is only gradually getting back on track, not least due to the supply shortages of electronic components. Other factors include high market volatility due to the coronavirus pandemic and the increase in the prices of raw materials. In particular, the European car market, which is very important for us, is still well below its record level of 2017. Furthermore, the market has not yet returned to its pre-coronavirus level of 2019.”

Strong regional differences in growth

In the first three months of the year, the development of automotive markets varied substantially throughout the world. The market development of passenger cars and light commercial vehicles in China was very strong (5.7 million units, +78.2 percent year-on-year). North America had a relatively weak start to the year compared to 2020 (3.6 million units, -4.5 percent year-on-year). In Europe, production of passenger cars and light commercial vehicles was on par with the low level of the previous year (4.6 million units, -0.3 percent year-on-year; 1.0 million units of which were in Germany, -9.0 percent year-on-year). According to preliminary figures, global production of passenger cars and light commercial vehicles grew by 14.0 percent year-on-year in the first quarter to a total of 20.3 million units (Q1 2020: 17.8 million units). Production in the first quarter was thus substantially lower than in the first quarter of 2019, when 22.9 million vehicles were produced.

Market outlook and forecast for fiscal 2021

For the current fiscal year, Continental continues to expect production of passenger cars and light commercial vehicles to increase by 9 to 12 percent year-on-year.

Continental is adjusting its outlook for the current fiscal year mainly due to the anticipated spin-off of Vitesco Technologies. For the continuing operations, and thus excluding Vitesco Technologies, the company expects sales of €32.5 billion to €34.5 billion and an adjusted EBIT margin of 6 to 7 percent for 2021.

For the continuing operations of Automotive Technologies, Continental expects sales of around €16 billion to €17 billion for the year as a whole. An adjusted EBIT margin in the range of around 1 to 2 percent is anticipated. This still includes higher supply chain costs as well as the additional expenses for research and development announced on March 9, 2021, in the Autonomous Mobility and Safety business area.

Sales in the Rubber Technologies group sector are still forecast to total about €16.5 billion to €17.5 billion, with an adjusted EBIT margin of around 11.5 to 12.5 percent. This includes the impact expected from higher raw material costs.

Taking into account the effects of the anticipated spin-off of Vitesco Technologies, Continental expects free cash flow before acquisitions, divestments and carve-out effects of around €1.1 billion to €1.5 billion from continuing operations. The increase is due in particular to the postponement of cash utilizations from restructuring provisions. For fiscal 2021, Continental continues to expect a capital expenditure ratio before financial investments of around 7 percent of sales for the continuing operations.

Spin-off of Vitesco Technologies scheduled for September 2021

Despite the challenging macroeconomic environment, Continental is systematically pursuing its strategic realignment. An important step in this direction is the full spin-off including stock market listing of its powertrain business. “Now that we have the approval of the Annual Shareholders’ Meeting, we will proceed with the planned spin-off in September 2021,” explained Wolfgang Schäfer, Continental’s CFO.

-

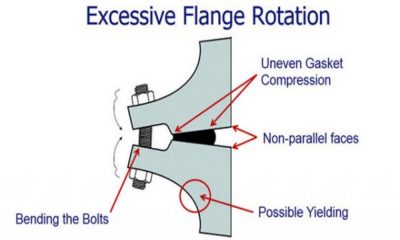

Industrial Hardware and Machine Parts9 years ago

Industrial Hardware and Machine Parts9 years agoThe necessity of bolted flange connection training

-

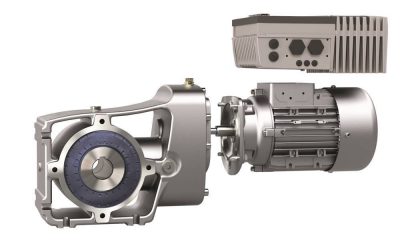

Drive systems6 years ago

Drive systems6 years agoIntelligent frequency inverters for digital production

-

Motors9 years ago

Motors9 years agoNew generation of hollow shaft motors

-

Industrial Hardware and Machine Parts8 years ago

Industrial Hardware and Machine Parts8 years agoABB and Formula E partner to write the future of e-mobility

-

Industrial Hardware and Machine Parts8 years ago

Industrial Hardware and Machine Parts8 years agoRexnord adds to its Autogard Torque Limiters with the XG Series

-

Motors9 years ago

Motors9 years agoZF Technology on the Winners’ Podium of the Dakar Rally 2017

-

Gear drives8 years ago

Gear drives8 years agoKlingelnberg at control 2018: Tactile and optical measurement on one machine

-

Motors8 years ago

Motors8 years agoGet a first-class ticket to productivity

-

Motion control8 years ago

Motion control8 years agoWhere the robots come from?

-

Motion control8 years ago

Motion control8 years agoRexnord to Acquire Centa Power Transmission

-

POWER TRANSMISSION TECHNOLOGIES5 years ago

POWER TRANSMISSION TECHNOLOGIES5 years agoEUROTRANS Board meets for its first session in 2021

-

Industrial Hardware and Machine Parts9 years ago

Industrial Hardware and Machine Parts9 years agoCustom hobbing tool enables 45-degree angles